Understanding the new pension math

Article Abstract:

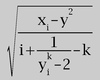

Financial Accounting Standard Number 87 (FAS 87), also known as 'Employers' Accounting for Pensions' (issued by the Financial Accounting Standards Board), is intended to improve footnote disclosure of pension information, and requires companies to report some of their unfunded pension liabilities on their balance sheets. Certain pension accounting principles remain intact, delaying recognition of certain events, net cost reporting, and offsetting assets and liabilities. However, the new reporting methods called for by FAS 87 are complex and require the use of actuarial computations. An example of the calculations needed for a noncontributory defined benefit plan is included in this explanation of the new accounting standards related to pension-providing corporations.

Publication Name: Management Accounting (USA)

Subject: Business, general

ISSN: 0025-1690

Year: 1986

User Contributions:

Comment about this article or add new information about this topic:

FAS 87 - what it means for business

Article Abstract:

Financial accounting standard 87 (FAS 87), Employers' Accounting for Pensions, issued recently by the Financial Accounting Standards Board, will vary in the way it affects business. Recognition of pension expense rather than pension funding is treated by the statement. FAS 87 calls for a single method of funding, the projected unit credit method, so that comparison is easier. In addition, FAS 87 requires faster amortization and breaking down pension costs into components for given periods. A decrease in pension expenses will probably be noted by companies with well-funded plans, while those which do not have well-funded plans may find their balance sheets affected by the requirement to show a liability. 10

Publication Name: Management Accounting (USA)

Subject: Business, general

ISSN: 0025-1690

Year: 1986

User Contributions:

Comment about this article or add new information about this topic:

FAS 105: an industry perspective

Article Abstract:

The Financial Accounting Standards Board's Statement of Financial Accounting Standard 105, Disclosure of Information about Financial Instruments with Off-Balance-Sheet Risk and Financial Instruments with Concentrations of Credit Risk, covers two types of disclosures: off-balance-sheet financing instruments, and concentration of risk in all financial instruments. Managerial accountants in charge of adopting the standard should review five areas pertaining to financial instruments: assets that have been recorded at less than face value, forward exchange contracts, guarantees, treasury initiated financing instruments, and unconditional purchase obligations.

Publication Name: Management Accounting (USA)

Subject: Business, general

ISSN: 0025-1690

Year: 1991

User Contributions:

Comment about this article or add new information about this topic:

- Abstracts: Understanding technology-structure relationships: theory development and meta-analytic theory testing. Functional background as a determinant of executives' selective perception

- Abstracts: AT&T is offering buyout packages to about half of its supervisory force

- Abstracts: Equity price reaction to the pronouncements related to accounting for income taxes. Predicting corporate takeovers

- Abstracts: An adaptive filter for estimating spatially-varying parameters: application to modeling police hours spent in response to calls for service

- Abstracts: Manpower matters: welfare and working conditions. Manpower matters: women's career developments